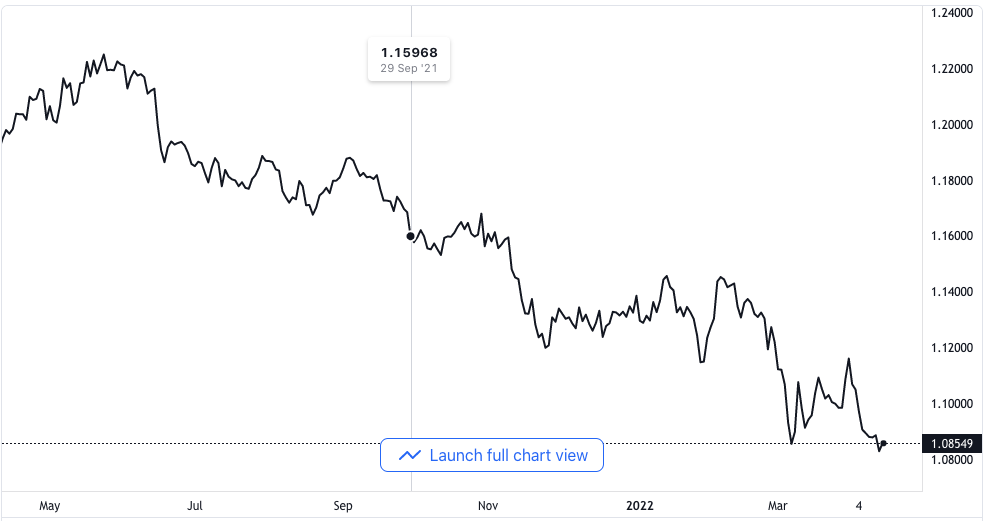

EUR/USD Jumps Out of New Low Points Close to 1.0810

The EUR/USD currency pair tried to have a lukewarm recovery after hitting a new low point of five weeks close to 1.0810 as the market began trading on Wednesday.

EUR/USD Looks to US Dollar and European Central Bank for Direction

The pair had a time of partial reversal of the average retracement it experienced on Tuesday. It, however, regained some of its composure following a brief approach to the area where there were the year-to-date low points at 1.0800 in the early part of the trading session.

EUR/USD price chart. Source TradingView

The continuous upward movement of the US dollar aided the US dollar index up to new heights; it was last seen in May 2020 in the vicinity of 100.50. This also came on account of the US bond yields’ resumption of its upward trajectory after the hiccup that accompanied the consumer price index on Tuesday.

Meanwhile, in the money market in Germany, the ten-year bond yields went on as envisaged and almost reached the latest top spots at 0.85%.

In the meantime, the Euro continued to be under immense pressure while being cautious on the backdrop of events and news coming out of Ukraine with regards to the ongoing war. The Euro is also reacting to the upcoming event of the European Central Bank slated for Thursday.

There is currently nothing else worthy of note in the domestic docket, but all eyes will be watching out for the expected Producer Price Index in the United States, scheduled for later this week.

What to Expect Around the Euro

Market sellers continue to direct the mood that revolves around the EUR/USD currency pair, which has stretched the downward trend to new low points to the 1.0810 area for the midweek. The negative performance of the pair observed over the course of many weeks came as a result of the stronger momentum that the US dollar has gathered as well as new geopolitical considerations.

As the case usually is, some flashes of strength shown by the US dollar seem to be supported by feeders that the European Central Bank might increase interest rates before the year comes to an end. Whereas increased bond yields in Germany, inflation elevations, a good pace of recovery in the economy, and favorable results from significant events and statistics in the Eurozone are equally supportive of a rally in the Euro.