AUD/USD Gropes for Direction, Consolidating Over 0.7000 Benchmarks as USD Gets Stronger

An attempt at Some Stability

The Aussie pair of the Australian and US Dollars has oscillated between lukewarm gains and little losses in the mid-European session. It is now looking stabilized in a neutral area in the vicinity of the 0.7020 zone.

After an early increase to a high point of one week, the AUD/USD currency pair saw an average pullback on the intraday from the area of mid-0.7000 early on Wednesday as there was an emergency of buying the US Dollar dip. The Chairman of the Federal Reserve, Powell, said that he would continue to support an increase in interest rates till prices of commodities fall back to healthy levels.

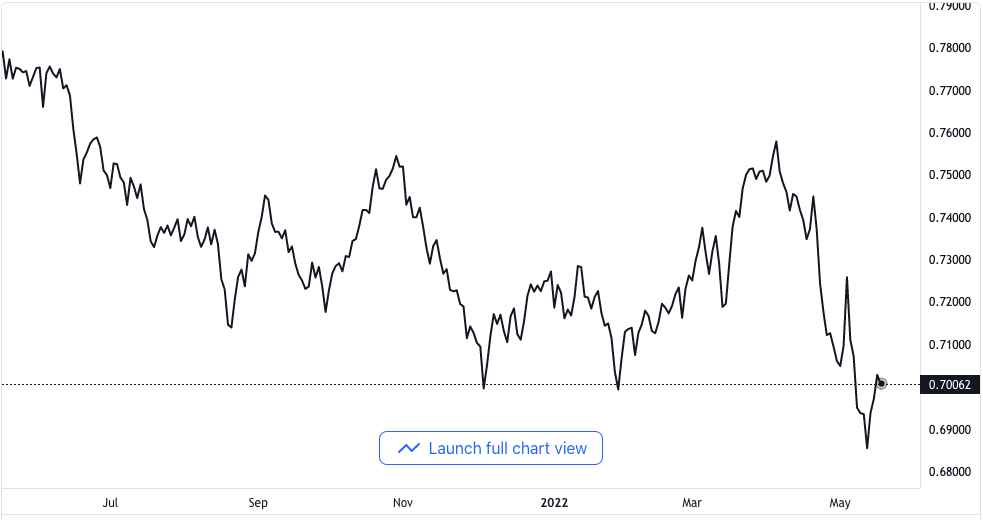

AUD/USD price chart. Source TradingView

The comments from the Federal Reserve’s Chairman confirm the market’s speculations that there would be an aggressive monetary policy implementation by the US Federal Reserve. It also helped the US Dollar to stop its latest fall from a high point of twenty years.

Effects of War and COVID

Investors in the pair are concerned that the war in Ukraine and the lockdown in China due to COVID might adversely affect the economic growth of many countries across the globe. The evidence of this was seen in the weakness of the stock markets across the board.

The stock markets’ weakness was of benefit to the US Dollar as it shored up safe-haven inflows to the currency but took attention away from the Australian Dollar which is generally considered riskier.

Meanwhile, Australia’s Reserve Bank had given signs that the possibility of a higher interest rate is still live for the month of June. This was revealed via the minutes of the meeting the bank held last. This move helps to reduce the loss the AUD/USD currency pair would have incurred.

The price of spots revealed that there is some level of resilience under the 0.7000 benchmarks. This directly calls for caution on the side of bears before they position to resume the latest slide seen in the last month.

Traders are now looking ahead to the housing data, as well as building permits and statistics from the United States. This data as well as bond yields from the US and the risk sentiments from the general market will be of influence on the US Dollar and its dynamics. It would equally let traders seize opportunities for the short-term around the AUD/USD currency pair.

Early in the market on Wednesday, the pair had struck a correction in the Asian session as the risk-on mood lost its grip. It first recovered from the 0.6990 level because the US Dollar bulls had a less busy schedule this week.

Investors in Australia are currently not sure of what to do over the Reserve Bank of Australia that could pull an unexpected move. The meeting minute which was published on Tuesday showed that the bank could increase interest rates by 40 basis points. It shows further that the Reserve Bank has begun to push the curve of its interest rates from the bottom.