GBP/USD Struggled for Acceptance Beyond 1.2600

USD Tried Some Consolidation

The GBP/USD currency pair made a reversal from a dip fallen into in the early European session. It was able to get back to almost a high of three weeks which it reached on Thursday. The pair was observed trading in the vicinity of 1.2585 to 1.2590.

The GBP/USD pair was up but less than 0.15% on the daily trade. The US Dollar struggled in its bid to consolidate on its bounce from the low point of a month. It, thus, edged the GBP/USD pair higher for the second day in a row.

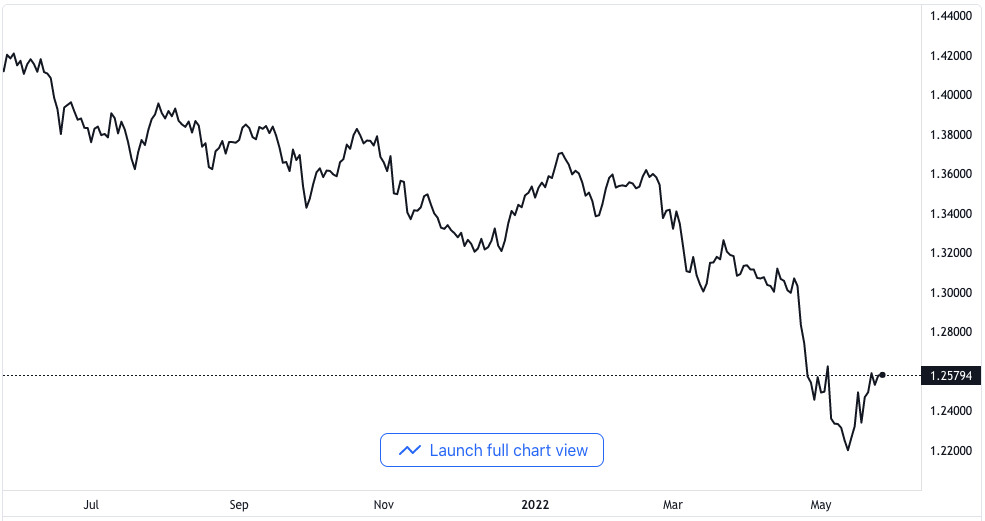

GBP/USD price chart. Source TradingView

The FOMC meeting minutes are published. They revealed that most actors at the meeting favored a 50 basis point rise. They simply believe that it would be right for the months of June and July.

The market has already fully priced in the expected 50 basis point rate increase. The absence of surprises confirms the market’s thought that the Fed could halt the rate increase. Halting the rate increase cycle is also a mechanism for fighting inflation when needed.

These developments as well as low tones around the Treasury yields are a headwind. They serve as a headwind to the US Dollar that is already losing some safe-haven flow.

More on the Global Economic Concerns

Worries about the declining global economy might benefit the US Dollar in days to come. The risk-off mood that envelops the market could also boost the Dollar’s safe-haven status.

Investors worry that the aggressive policies from central banks could challenge the global economy. These policies are designed to combat high inflation to a standstill. Other factors that could be a challenge include the war in Ukraine.

Lesser possibilities of more rate increases from the BOE could hold off bullish bets. The same effect could come from the difficulties around Brexit negotiations. They are all going to restrain bulls from staking their necessary bets.

This, therefore, calls for caution on the part of bulls before positioning for gains. All moves towards betting on the GBP/USD pair would require clarity.

There is no significant data to move the market on the horizon from the UK. That leaves the GBP/USD pair in the hands of the US Dollar and attendant factors. Traders will take their cue from the American docket in the American session.

The American docket is expected to feature the preliminary quarter one GDP report. It would also feature the weekly jobs report and pending house sales.

Risk sentiment in the general market would influence the US Dollar demands. It would also give a trading opportunity around the GBP/USD currency pair.