EUR/USD Bearish Investors Drill for 1.300 amidst Russia-Ukraine Fears, Rush for Safe-Haven

Shocks of loss

The EUR/USD trading pair is trying to cope with market realities as it witnessed a new weekly low around 1.1288 in the course of a four-day downward trend leading up to Tuesday’s European session. With that, the leading currency pair will rely on the dollar’s demand as a safe-haven commodity to satisfy bears with little gains as geopolitical news about Russia and Ukraine become more intense.\

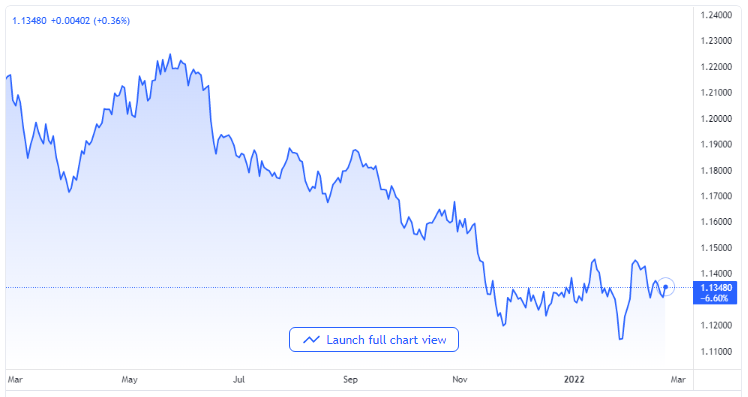

EUR/USD price chart. Source TradingView

Russia Aids Secession

Market risk appetite was lost late on Monday when Russia’s President Vladimir Putin signed off on Luhansk and Donetsk regions in Eastern Ukraine to become independent counties, followed by signing a decree on cooperation and friendship. To further add to the market’s risk-off pulse was Russia’s order sending its troop into Eastern Ukraine for a peacekeeping mission.

The event increased fears of an imminent invasion of Ukraine by Russia, as Western leaders have initially warned. Consequently, the United Nations convened an emergency meeting recently where Rosemary DiCarlo, the SG for Political Affairs, said that the deployment of Russian troops in Eastern Ukraine on the guise of a peacekeeping mission is regrettable.

Western governments’ readiness to announce further sanctions on Russia has added to the already heightened market fears. Russia, however, defended its recent military venture when the country’s UN envoy said that Russia does not intend to allow a new bloodbath to take place in the Donbas region.

Standing on the same ground with the Russian envoy, the Chinese Ambassador to the UN, Zhang Jun, however, urged caution and said that every side involved in the conflict had to exercise restraints and stay away from actions that might increase tensions.

China’s subtle warning towards the US asking it to withdraw from issues regarding Taiwan and recent gentle comments from top officials of the Federal Reserve, as well as European Central Bank’s hawkish statements, all pose a challenge to the EUR/USD investors ahead of a full market resumption.

In a reflection of the market mood, S&P 500 dipped more than 1.60%, while the US ten-year Treasury bond yields dropped by seven bps to 1.85%.

Meanwhile, activity figures in the Eurozone improved significantly in February, thereby giving validation to the latest upbeat statements from policymakers. It is expected that Germany’s IFO figures scheduled to be released on Tuesday might add more support to the argument from bulls and could pose a challenge to the EUR/USD traders.

The market’s risk-off pulse and a possible firmer February Purchasing Managers’ Index in the US indicated that the bears trading the EUR/USD pair might keep the reins.