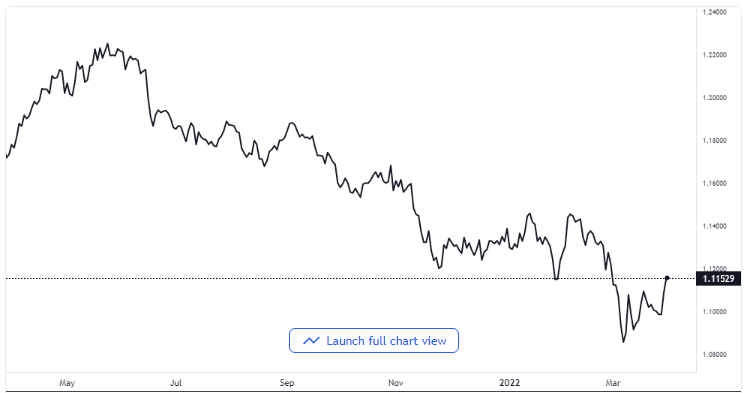

EUR/USD Sinks to New Depths Below 1.1030 While US Dollar Gains Strength

The EUR/USD currency pair slipped further beneath to a new low point of three days’ record in the course of the American session on Friday. The pair dropped to 1.1026 while the US dollar gained more momentum for the day. The market’s bias continued on the downward trend as the pair got set to begin shedding its weekly profits.

US Dollar Goes Up Following Non-farm Payroll Release

The US dollar gained more strength after the start of the American session while market sentiment was deteriorating and the US equity indices were shedding their gains at the same time. Reports on the US economy came in with mixed statistics but it generally looked to be in favor of the US dollar.

EUR/USD price chart. Source TradingView

The Manufacturing index of the ISM fell to 57.1 in the month of March as reported from the height of 58.6. The S&P Purchasing Managers’ Index, on the other hand, had a slight upward revision from 58.5 to touch 58.8.

Earlier in the day, the employment report revealed that 431,000 more jobs were created in the economy in the month of March, which fell below the 490,000 that was initially expected. The US unemployment rate, on the other hand, fell to 3.6% being the lowest it had seen since 2020. Analysts at TD Securities said that the dial of the US dollar dynamics does not get changed by just a strong report. Of all things, they expect that the numbers will help to give validation to prices in the market for an overall Federal Reserve’s monetary policy strengthening and the market bias this quarter with a fading EUR/USD extreme.

The Euro Ends the Week Badly

In spite of losing grounds during trading on Friday for the second straight day, the EUR/USD currency pair is still standing quite firm for the week. From the high point on Thursday, the Euro lost over a hundred points. At the end of the day, it hit a bottom at 1.1026 and continues to be under immense pressure.

The US dollar, on its part, is also ending the week with some losses, but it is not in the weak terrain. The US dollar index rose by 0.35% during trade on Friday at 98.70. This validated its recovery after it had traded below 98.00 in the course of two days before now.

A lot of focus now will be given to the conflict between Russia and Ukraine as mediators seek to help find a resolution to the war.