Effects of Bitcoin Halving on the Mining Network

The Bitcoin halving event is an event that occurs every four years after a certain number of blocks are produced from the digital assets mining network. The event signifies the bedrock for the value behind the adoption of the asset. With every halving event that occurs, the number of Bitcoin produced per block is reduced by half making it hold more trading value that the last one. The last halving that occurred on the Bitcoin network saw the value of Bitcoin produced reduce from 12.5 per block to 6.25 per block.

The Bitcoin halving event is an event that occurs every four years after a certain number of blocks are produced from the digital assets mining network. The event signifies the bedrock for the value behind the adoption of the asset. With every halving event that occurs, the number of Bitcoin produced per block is reduced by half making it hold more trading value that the last one. The last halving that occurred on the Bitcoin network saw the value of Bitcoin produced reduce from 12.5 per block to 6.25 per block.

The Bitcoin halving usually has adverse effects on miners with some of them choosing to abandon mining on the Bitcoin network as a result of the reduction in profits generated. Aside from the challenges that miners face after the halving, the halving spells good for the crypto community with some traders preferring to hold assets days or weeks before the halving.

The real impact of the Bitcoin halving event

As previously stated, after Bitcoin undergoes the halving event, the number of Bitcoin produced per block gets immediately reduced by half which means miner’s rewards get reduced. The Bitcoin halving event has always been a torturing experience for miners with the recent halving seeing miners revenue drop a tragic 48 percent. After the halving, miners saw about 13 percent out of their profits charged as Bitcoin network transaction fees.

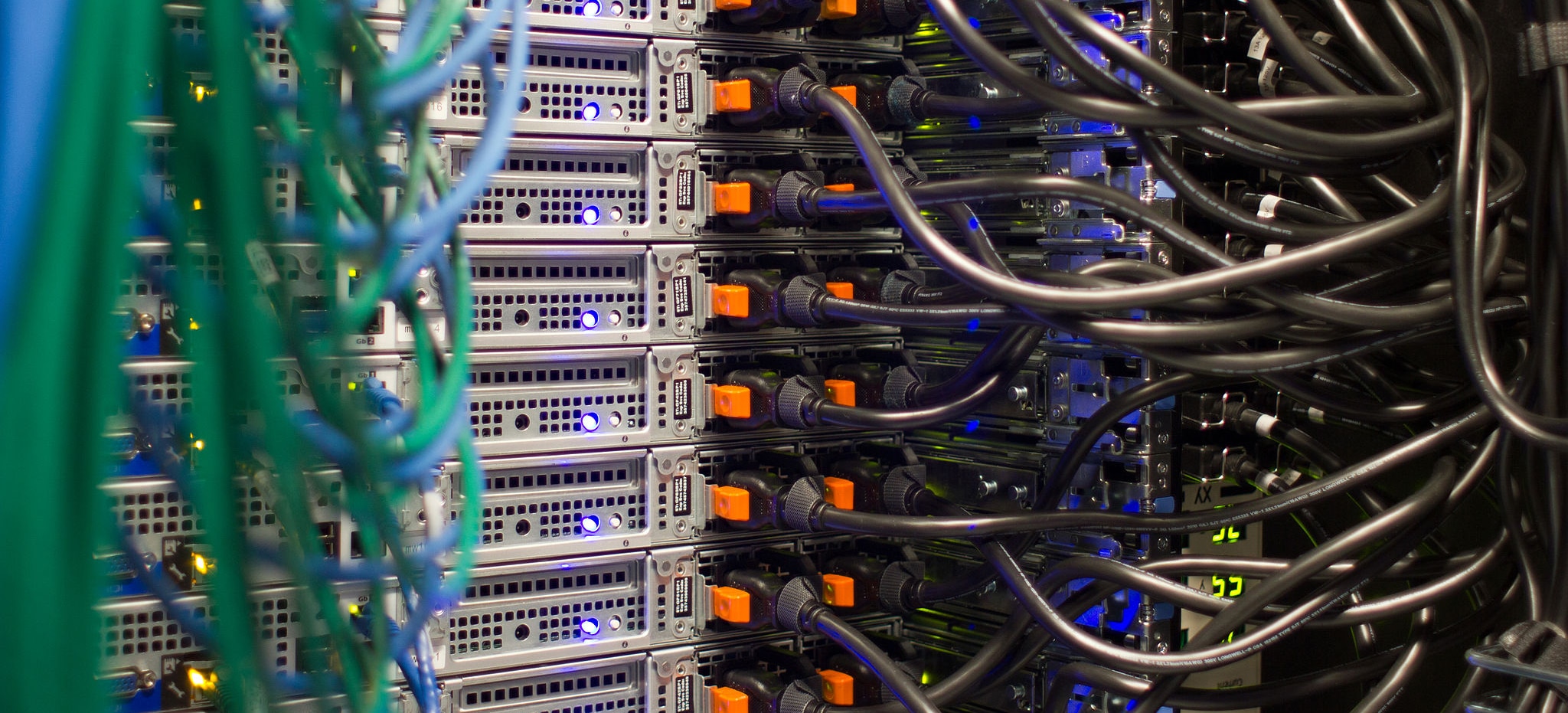

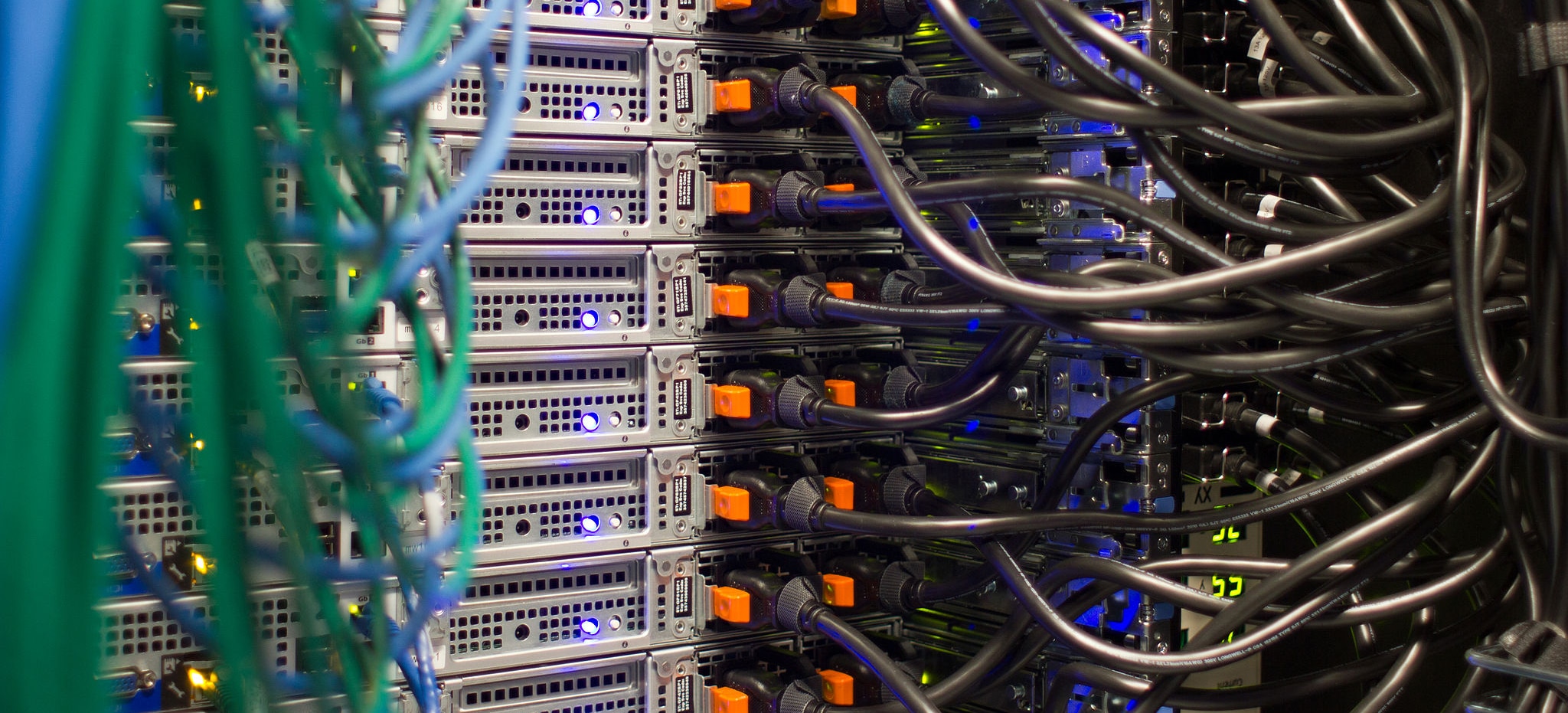

With this encroachment on their profits, miners have now slightly increased the Bitcoin transaction fee to be able to stay afloat. Presently, the transaction fee has made a surge as high as 400 percent which happened immediately after the last halving event. Another effect of the halving event is the reduction of the hash rate after major miners abandoned the Bitcoin mining network, and this development has led to weak security of the network.

Solving the post halving problems

With the problems arising after the halving events too much to handle, experts and analysts alike have given ideas on how to solve the problems. Big miners have to split their mining pools into smaller pools to maximize the reward gotten from the blocks. Big firms were asked to cut their investments in established mining pools and give smaller pools a chance. Finally, mining pools should be rescaled to give room to new miners who wish to join the network, and hash rate should be reconfigured to help in the security of the mining network.