EUR/USD Still in Bid, Upside Extends Further than 1.0800

The US dollar continues to enjoy renewed optimism, and it is currently pushing the EUR/USD currency pair to new heights not seen in many days, which are in the area of 1.0850.

EUR/USD Pair Looks Up to Bond Yields and US Dollar for Direction

The EUR/USD pair has advanced again for the second consecutive session, and it prolonged the latest round of breakout for the barrier around 1.0800 in the midweek.

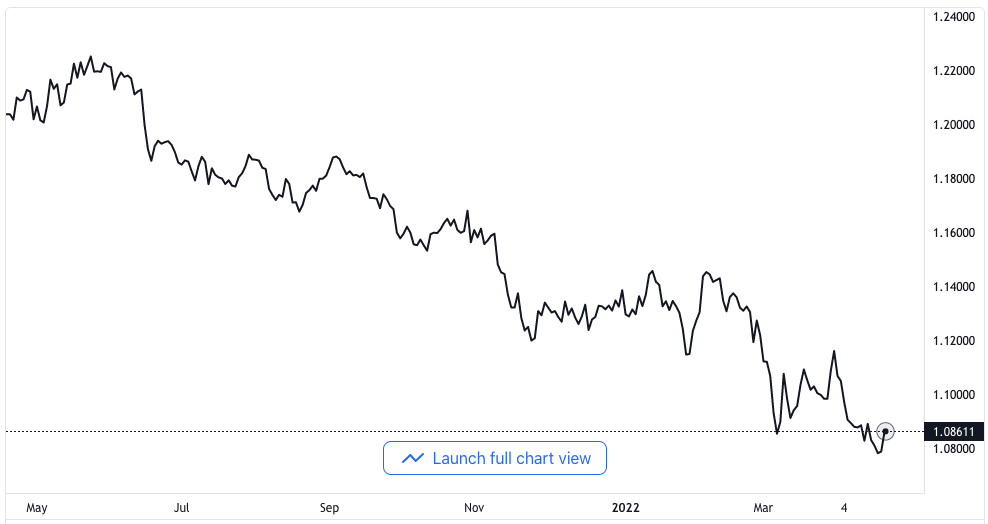

EUR/USD price chart. Source TradingView

More gains in the price of the spot came as a result of the newly offered set of biases towards to buck as well as the correction movement going on with the US bond yield. On the latter end, the ten-year benchmark yield in Germany has given away considerable gains following its trade close to the 1.00% psychological barrier on Tuesday. It is a zone that was last seen in the middle of July 2015.

In the Eurozone’s domestic calendar, the producer price index in Germany rose by 4.9% in the month of March alone and up to 30.9% in the course of the past twelve months. Additionally, the trade deficit in the wider Eurozone plummeted to 7.6 billion Euros in the month of February, and industrial production in the region increased by 2.0% year-on-year in the same timeframe under review.

In the latter part of the session, home sales and mortgage applications would be due for release in the US, while the Federal Open Market Committee’s Daly and Evans will be set to deliver an address.

Expectations to Have Around the Euro

The pair was able to recover some of its composure and was able to surpass the 1.0800 mark, establishing a wider distance away from the past week’s low point, which was set for the year at mid-1.0700 on the back of the European Central Bank’s event. In spite of the continued bounce off, the perspective for the currency pair is still very much in the bearish territories for now, as it is perpetually responding to dynamics around the US dollar as well as the geopolitical atmosphere.

The periodic shows of strength in the US dollar might seem to be reinforced by suggestions that the European Central Bank is set to increase interest rates before the end of 2022, whereas improved German yield, elevated inflation, economic recovery, and goodish results from major indicators in the Eurozone all give support to the recovery of the Euro.