10 Crypto Vocabularies You Might Need to Learn

Getting a hold on the crypto vocabularies may make it easier for investors and traders to understand how cryptocurrency works. In today’s digital world, cryptocurrency may sound like too steep a learning curve. Experts believe that many individuals get confused with crypto probably because of terms that they have never heard.

Getting a hold on the crypto vocabularies may make it easier for investors and traders to understand how cryptocurrency works. In today’s digital world, cryptocurrency may sound like too steep a learning curve. Experts believe that many individuals get confused with crypto probably because of terms that they have never heard.

Here are some most commonly used cryptocurrency vocabularies or terminologies. This way, you can have an essential glossary to have a foundation to build a successful crypto trading building.

1. Address

In the cryptocurrency world, an address refers to a specific destination on the network where you can send your digital coins. This address is like a bank account where you can keep cryptocurrency only. Every address consists of alphanumeric characters that a recipient can use to receive cryptocurrency. Crypto users can use every address once since it offers a unique and highly secure destination to hold cryptocurrencies.

2. Fork

Changes to blockchain rules may result in two different directions. One follows the old rules while the new one splits the blockchain off from the preceding one. Bitcoin Cash, for instance, is a fork of bitcoin.

3. Gas

It is the fee you need to pay to make a crypto transaction on the blockchain. This amount is the cost a miner receives to find and receive cryptocurrency on your behalf. Usually, the size of the cost depends on how swiftly you want to complete the transaction.

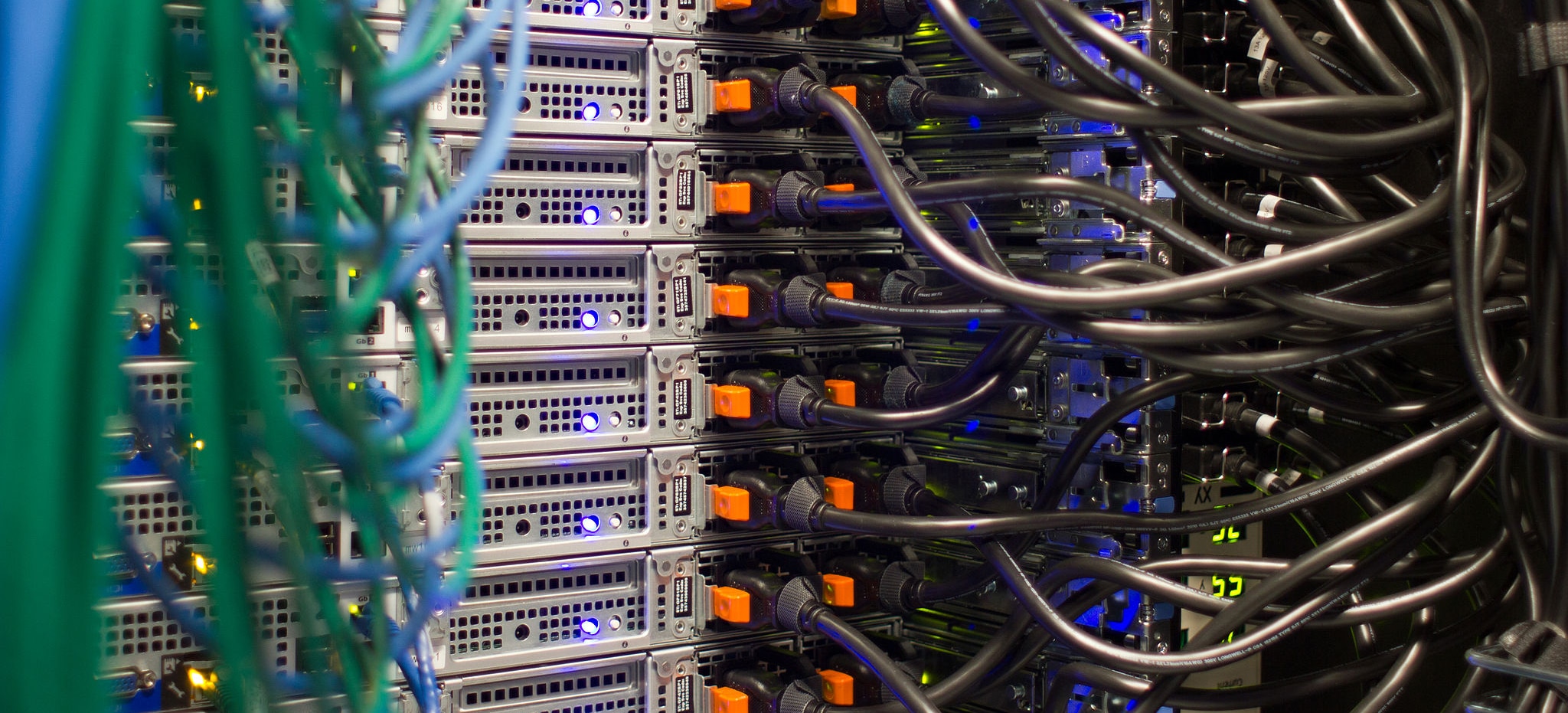

4. Mining

Crypto mining is the process to enter new bitcoins into circulation. It requires powerful hardware with the capacity to solve complex mathematical puzzles and create a new block on the public ledger. Mining also entails adding safety procedures to secure the transaction.

5. Hold On Dear Life

The term Hold On for Dear Life or HODL was invented when a user typed something like this on the Bitcoin forum almost eight years ago in 2013. It is a passive investment policy that allows you to buy and hold onto different digital currencies instead of selling them, hoping that their value will increase.

6. Know Your Customer or KYC

Many platforms use a scanning procedure to verify users’ identity to help prevent using digital currencies for unlawful activities. This scanning procedure involves submitting identity proof such as a residential address, passport, and IDs, to ensure qualified and authentic users. KYC specifically helps eliminate criminals and making a database to prevent illegal activities in the future.

7. Anti Money Laundering or AML

Financial institutions need to apply a range of regulations and procedures to identify and prevent illegal activities to protect the crypto industry. Market manipulation, tax avoidance, public fund corruption, and trading illegal goods are a few unlawful activities that aim to destroy the cryptocurrency market.

8. Halving

It is a feature written into the code of bitcoin. Mining a certain number of blocks adds new bitcoins to circulation and gets halved. Bitcoin price can go up or down due to the halving process.

9. Market Capitalization

Market cap, for digital currency, is the total value of all mined coins. You can multiply the existing number of crypto coins by the current price value of the digital coins to identify their market cap.

10. Whales

Whales refer to a trader or group of traders powerful enough to influence any cryptocurrency’s price value. Cryptocurrency addresses with the most value are ‘whales’ in the market. A group of whales, for instance, can together decide to sell their BTCs simultaneously. It will naturally and instantly drop the value of the coin. These whales can subsequently make a profit and buy new coins at a minimal price.