Analysts Positive Tesla Stock Price Will Rise To $2,000 Despite All Time Drop

Tesla Stock Price Analysis

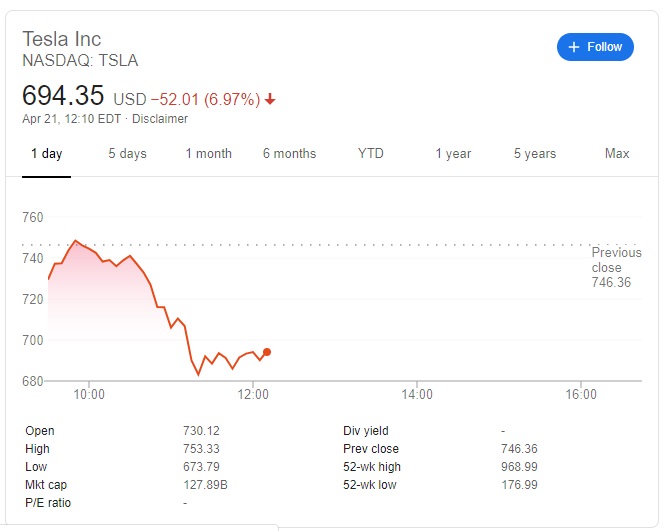

has been recording what could best be described as a “negative day” as stock price decline as a result of the major fall in the price of crude oil with the West Texas Intermediate(WTI) dropping as low as below the zero mark. Tesla, which recorded an all-time high earlier this year when it reached the $9,000 before the effects of Coronavirus hit hard on the price in the stock market. As a result of the impact, Tesla saw its stock price go as low as $360 before it started making little recoveries to stay at its current $729, a 2.2% reduction ahead of the opening bell. The effects can be seen on S&P 500 futures as they recorded a downturn at an all-time low of 1.6%.

Despite the drop in price of crude oil, analysts are still hopeful that there might be a surge in the stock price of Tesla in the coming days. Market analyst for InvestorPlace, Luke Lango, has reiterated that the car makers fortune in the stock market could come up as high as $2,000 in the coming days.

Factors That Could Make Tesla Hit $2,000

Lango touched several reasons why he thinks Tesla could make a surge up to $2,000 in the coming days, with the major reason being the high sale of the electric vehicle in the coming days. He further stated that the reason he predicted the high rate of purchase is because the vehicle-making company makes vehicles that give enough advantages to its customers.

Lango’s second reason was mainly that from 2016 to 2019, Tesla recorded more than 600% deliveries of its electric vehicles globally as clients, as well as government agencies, backed the cars. Even with such growth over a short time, electric vehicles are estimated to make up a meager 3.5% of annual car sales, but it could rise to as much as 10% or even 20% in the coming years.

Lango cited his third reason around the population of buyers of electric cars. He stated that since the make of model 3, Tesla’s market share had grown considerably, especially with the population of buyers in China.

Even with the theory put forward by Luke Lango, other analysts have been quick to dismiss it because they think it’s a high-risk investment. With most of them arguing that Tesla might not be the only company making electric vehicles in the nearest future with Nissan and Chevrolet, making them too. Even with a cheaper model 3 car that costs roughly $30,000 before tax incentives, Volkswagen, BMW, and Porsche would be forced to go into the market, thereby proving too big a competition for Tesla.