Tech Stocks of Tesla and Apple Are Likely To Fall: Says Jeff Mills

According to reports, Jeff Mills who is a famous money manager, said that according to his personal opinion the stocks relating to giant companies of the world namely Apple and Tesla will likely see a gradual downward.

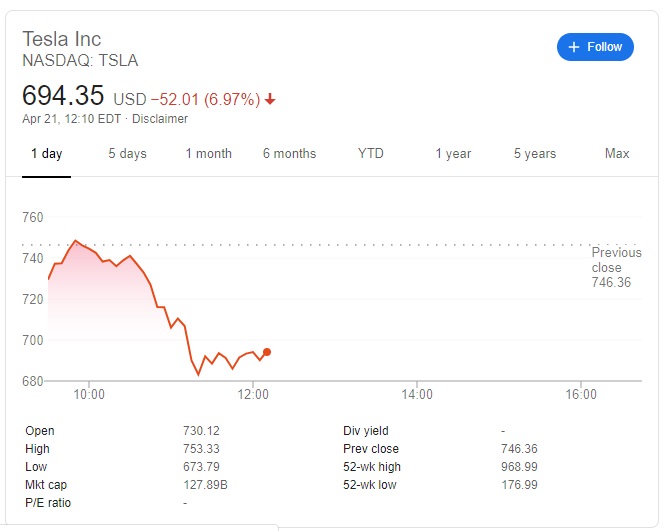

During an interview with CNBC, he reported to have said that while for the time being Tesla is managing to sell its stock above 80% irrespective of its normal 200 days average movement though the company had seen a 21% drop per day since the past week. On August 31, both, Tesla and Apple had offered a scheme according to which they had allowed the buyers of their stocks to have stock split which though had helped both to sell piles of their stock however from the last week both are subject to a gradual fall.

He further said that the split schemes actually make no good for the investors because they do not build value. However, they are inclined to invest in the scheme because of the fact the other investors believe that such schemes are not to be ignored. According to him, this is the theory that has been duly adopted by Tesla and Apple so as to make people that they must buy stocks of these companies otherwise if they are failed to get their hands on the stocks then others might get the stocks.

On the other hand, Nasdaq had seen the worst week within this meet as it had been able to close 10% lower than what it had closed last Friday. The results were obvious i.e. there was a 10% drop recorded by Nasdaq from last week’s performance of its stocks.

However, companies who are involved in online retail business as well as Zoom were able to see a big push for the past many months, especially in the months when the Covid-19 crisis was on the horizon.

Over the years Tesla as well as Apple had undoubtedly been the world’s biggest franchises whose past 12 months’ performances show that they had raised around 650% above.